There is no monthly fee, and the annual management fee is tiered based on the investment amount. Even if you’re not quite ready to take advantage of the financial advisor, you can use Personal Capital to track your finances and investments in one place.

FREE FINANCIAL SOFTWARE FOR HOME SOFTWARE

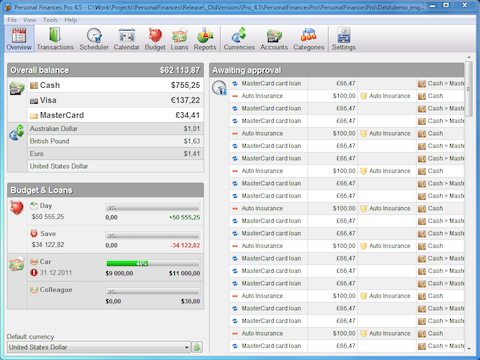

Use the software to tell whether you’re on track with your retirement and other investment goals. While you’re charged a fee for this service, financial advisors are obligated to provide you with advice that works in your best interest. If you have a portfolio of more than $100,000, you can get personalized financial advice based on your goals. If you have multiple accounts-as most of us do these days-using Personal Capital can save you from having to switch between multiple screens to understand where you stand. To get the guidance and advanced features you will have to go with the paid tools. a free software will be a good option for the requirement of tracking and categorization of money with basic functionalities.

FREE FINANCIAL SOFTWARE FOR HOME PLUS

You can include your bank accounts, mortgage, and other credit accounts, plus your investment accounts, to have your complete financial picture right in front of you. The selection of the Personal Finance Software depends largely on your requirement of the types of features. Personal Capital allows you to manage all your financial accounts in a single platform. Quicken personal finance and money management software allows you to manage spending, create monthly budgets, track investments, retirement and more. While you can use TurboTax on the web, you can also download the software to your device for added security. Paid versions of TurboTax include a feature to help you uncover deductions you may not have known were available to you. On the higher end, TurboTax Live connects you with a tax expert to give you personalized advice and answer questions about your tax return. The most basic version lets you file your federal and state return for free if all you use is form 1040 with no attached schedules. If you’ve used TurboTax in previous years, the software will remember your personal information and ask whether there have been any major changes. Entering your tax information is fairly simple-you can import your W-2 information from your employer or take a picture of it and the software will transfer the information into the form. While it’s one of the pricier tax preparation tools, it’s also consumer-friendly, walking you through your tax preparation to help you accurately file your tax return. You can manage your bank accounts, stocks, income, expenses, and more using the app. The accounting software is freely licensed and it is very easy to use. It is compatible with Mac and Linux as well.

You may not necessarily need TurboTax to manage your finances throughout the entire year, but when it’s tax time, the software can come in handy. GnuCash is the best personal finance software for Windows users.

0 kommentar(er)

0 kommentar(er)